While real estate markets shift over time, we’re firm believers in the idea that owning real estate is a foundation of wealth if you do it right. That may mean making sure your own home is a good investment, but it also definitely includes income properties.

Here on the Refined team, we love income properties. Love ‘em!

- We love seeing a mortgage go down each month, paid for by tenants.

- We love seeing the property appreciate over time.

- We even love overseeing renovations that add value and allow us to charge higher rents and attract better tenants.

It’s because we love income properties that we get excited when we start working with a client looking at buying one. If you’ve been considering buying an income property, we thought we’d share a quick way of assessing different income properties. It’s called the capitalization rate, or cap rate for short.

Nice cap.

The cap rate for a property gives you a number (expressed as a percentage) that tells you how long it will take for the rental income from a property to pay off the purchase price.

The higher the number, the quicker the purchase price is paid off.

For example, a 5% cap rate means that every year, the rental income (less operating expenses) pays off 5% of the purchase price. That means that in 20 years, the cashflows from the property have paid for it completely.

Let’s attach some dollars to the example.

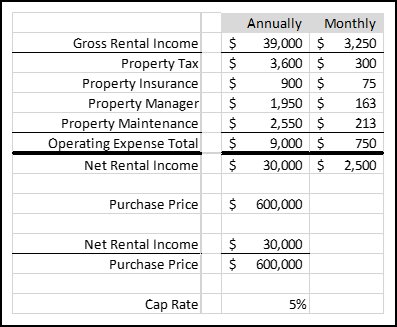

Consider a property located in a smaller city outside the GTA that’s for sale for $600,000. The property is triplex with three one bedroom units in it, which bring in $3,250 per month in rental income. We have property tax, some basic building insurance, a property manager to handle the calls about problems (at 5% of gross rent) and then some funds for keeping the place up. That totals $9K a year, which leaves us with net rental income of $30K.

On a purchase price of $600K, that $30K net rental income gives us a cap rate of 5%.

Note that the cap rate is calculated without taking into account the cost of borrowing. This is done because every investor will have different options for borrowing. Some may have the money to buy it outright, some may have a connection that will invest for 2% interest a year, others may need to borrow from banks or other lenders at hefty interest rates.

The cap rate allows income properties to be compared on an apples to apples basis.

Investors can look at a $300K single family home in Port Severn or a $1.6M multiplex in Toronto and be able to see what the cap rate will be for each property.

Now that we’re clear on how cap rates work, let’s get into the three rules to follow to make sure you choose a great income property.

Rule #1 – Multi-units Almost Always Beat Single-Family

Properties with multiple rental units in them (whether a bungalow with a basement apartment or a multi-plex with 4 purpose built apartments) almost always beat single tenant properties. While it can be very easy to rent out a lovely home to a lovely family, the rental rates are not typically high enough to provide the same return as multiple unit properties.

In addition to the higher rental income, multi-unit properties also avoid the all or nothing problem that single family homes have for investors. When you have a property with three or four units in it, it is quite rare for you to have more than one or two vacancies at a time. Given you have to pay property taxes, utilities and likely a mortgage payment each month, having some level of income coming in to offset those costs is a very good thing.

While you could own multiple single-family homes to spread the risk of vacancies over your income property pool, you also then have multiple properties where costs can be incurred for issues. Rather than one roof, one HVAC unit, one front porch, you have one for each of your properties and that means increased risk of higher maintenance costs.

Rule # 2 – The Greater Toronto Area means Greater Cap Rates

While properties in Toronto are certainly in demand with renters, the cost of buying the property means that your cap rate will likely be lower. An income property in Ajax can literally be half the cost of a nearly identical property in Toronto. While rents may be lower in Ajax, they aren’t half the rent of Toronto. As long as you are careful to buy in a good location where you don’t have lots of vacancy, the lower rent can be easily made up for by the lower purchase price, which means a much better cap rate.

While you may not live close to an area that has the combination of lower prices and reasonably high rental rates, the math can be favourable enough to allow you to hire a property manager to properly oversee a place you purchase there. Yes, you’ve got higher operating costs with a property manager, but the lower purchase price can make up for that. If you ask us, removing the work of managing a property yourself at no effective cost makes a ton of sense.

Looking even further afield can result in even lower purchase prices, but be cautious you’re not buying in an area where rental rates are too low – or vacancies too high – to make up for the lower cost to buy. After all, owning an income property with little to no income is not the goal!

Rule # 3 – Focus on the Negatives to get the Positive Returns

Some of the best income properties are properties that we would never advise a client to buy as their own family home. Stigmatized properties – such as those backing onto power lines, fronting onto a busy street, or located beside commercial elements – can make fantastic income properties.

Buyers looking for their own home are often not too interested in such properties, which keeps the purchase price lower. Tenants typically take shorter-term views than buyers and are often more interested in the utility of a rental (transit proximity, amount of space inside) than the long-term prospects for the property.

Make sure you don’t ignore issues with a property or neighbourhood that a tenant will care about just as much as an owner. Homes in areas with bad schools are avoided by parents regardless of whether they own or rent, and health or safety issues with a property are legally required to be addressed by a landlord. We work to find our clients the right mix of an appealing rental property with some aspects that make home owners shy away.

We really do love working with clients to find them income properties and we’d love to work with you to find a great investment property. If that sounds appealing, then get in touch with us to discuss next steps!